The 7-Second Trick For Offshore Trust Services

See This Report about Offshore Trust Services

Table of ContentsFascination About Offshore Trust Services3 Easy Facts About Offshore Trust Services ShownThe Greatest Guide To Offshore Trust ServicesThe smart Trick of Offshore Trust Services That Nobody is DiscussingRumored Buzz on Offshore Trust ServicesHow Offshore Trust Services can Save You Time, Stress, and Money.See This Report on Offshore Trust ServicesNot known Details About Offshore Trust Services

Personal lenders, even bigger exclusive corporations, are much more amendable to resolve collections versus borrowers with complex as well as efficient possession defense strategies. There is no asset security strategy that can hinder a very encouraged creditor with unrestricted cash and also patience, yet a well-designed offshore trust usually offers the debtor a desirable negotiation.Trustee firms bill yearly costs in the variety of $1,000 to $5,000 annually plus hourly prices for additional solutions. Offshore trust funds are except every person. For lots of people living in Florida, a residential asset defense strategy will certainly be as effective for much less money. But for some people dealing with challenging lender troubles, the offshore depend on is the very best option to shield a substantial quantity of assets.

Borrowers might have extra success with an offshore depend on plan in state court than in a bankruptcy court. Judgment financial institutions in state court litigation might be frightened by offshore property security trusts and might not seek collection of possessions in the hands of an offshore trustee. State courts lack jurisdiction over offshore trustees, which indicates that state courts have restricted remedies to buy compliance with court orders.

Offshore Trust Services for Dummies

debtor data bankruptcy. A bankruptcy borrower have to give up all their properties as well as legal interests in building any place held to the insolvency trustee. Bankruptcy courts have globally jurisdiction and are not hindered by foreign nations' refusal to recognize basic civil court orders from the U.S. A united state personal bankruptcy court may compel the insolvency debtor to do whatever is called for to turn over to the personal bankruptcy trustee all the borrower's possessions throughout the globe, including the borrower's beneficial rate of interest in an offshore count on.

Offshore possession protection trust funds are much less reliable against IRS collection, criminal restitution judgments, and family members sustain obligations. 4. Also if an U.S. court does not have jurisdiction over offshore depend on possessions, the united state court still has personal territory over the trustmaker. The courts might attempt to urge a trustmaker to dissolve a count on or bring back trust fund possessions.

The trustmaker must agree to quit legal rights as well as control over their trust fund possessions for an overseas depend efficiently safeguard these possessions from united state judgments. 6. Choice of a professional and also dependable trustee that will certainly safeguard an offshore trust fund is more crucial than picking an offshore count on jurisdiction.

Unknown Facts About Offshore Trust Services

Each of these countries has count on statutes that are desirable for offshore possession protection. There are refined legal distinctions among offshore trust territories' laws, yet they have extra functions in common. The trustmaker's selection of country depends mainly on where the trustmaker really feels most comfy placing properties. Tax obligation treatment of international overseas depends on is really specialized.

Official statistics on counts on are difficult to come by as in the majority of offshore territories (and in most onshore territories), depends on are not required to be signed up, nonetheless, it is believed that the most common usage of offshore trust funds is as part of the tax obligation and also financial planning of well-off individuals and also their family members.

The Ultimate Guide To Offshore Trust Services

In an Irreversible Offshore Trust might not be changed or liquidated by the settlor. An enables the trustee to make a decision on the distribution of revenues for various courses of beneficiaries. In a Fixed trust, the distribution of earnings to the recipients is repaired as well as can not be transformed by trustee.

Confidentiality and privacy: Regardless of the reality that an offshore trust fund is officially registered in the government, the parties of the trust, properties, and the conditions of the depend on are not tape-recorded in the register. Tax-exempt condition: Possessions that are transferred to an overseas trust fund (in a tax-exempt offshore zone) are not tired either when moved to the trust, or when moved or rearranged to the beneficiaries.

How Offshore Trust Services can Save You Time, Stress, and Money.

This has actually likewise been done in a variety of united state states. Rely on general go through the policy in which offers (briefly) that where depend on home consists of the shares of a company, then the trustees must take a positive role in the affairs on the business. The policy has been criticised, however stays component of trust law in numerous common regulation territories.

Paradoxically, these specialist forms of counts on seem to occasionally be made use of in regard to their original intended usages. STAR trusts appear to be utilized much more frequently by hedge funds creating shared funds as system trusts (where the fund managers wish to get rid of any kind of commitment to attend conferences of the companies in whose securities they spend) and also view trusts are regularly used as a component of orphan structures in bond concerns where the trustees want to separation themselves from supervising the releasing automobile.

Specific territories (significantly the Cook Islands, however the Bahamas Has a species of asset defense trust) have actually offered unique counts on which are styled as property protection depends on. While all depends on have an asset protection aspect, some territories have actually established laws trying to make life tough for financial institutions to press claims versus the depend on (for instance, by offering for specifically brief restriction periods). An offshore trust is a tool utilized for possession security and estate preparation that works by transferring possessions right into the control of a legal entity based in an additional nation. Offshore trusts are irrevocable, so count on owners can't recover ownership of transferred assets. They are also complicated and pricey. However, for individuals with better responsibility problems, offshore trusts can give defense and also higher privacy in addition to some tax advantages.

Unknown Facts About Offshore Trust Services

Being offshore includes a layer of defense as well as personal privacy as well as the capability to take care of taxes. Since the trusts are not located in the United States, they do not have to adhere to United state legislations or the judgments of United state courts. This makes it harder for financial institutions and litigants to go after cases against assets held in offshore counts on.

It can be challenging for 3rd parties to identify the possessions as well as proprietors of overseas trusts, which makes them aid to privacy. In order to establish an overseas trust, the primary step is to select an international nation in which to locate the counts on. Some popular areas include Belize, the Chef Islands, Nevis and also Luxembourg.

Offshore Trust Services - An Overview

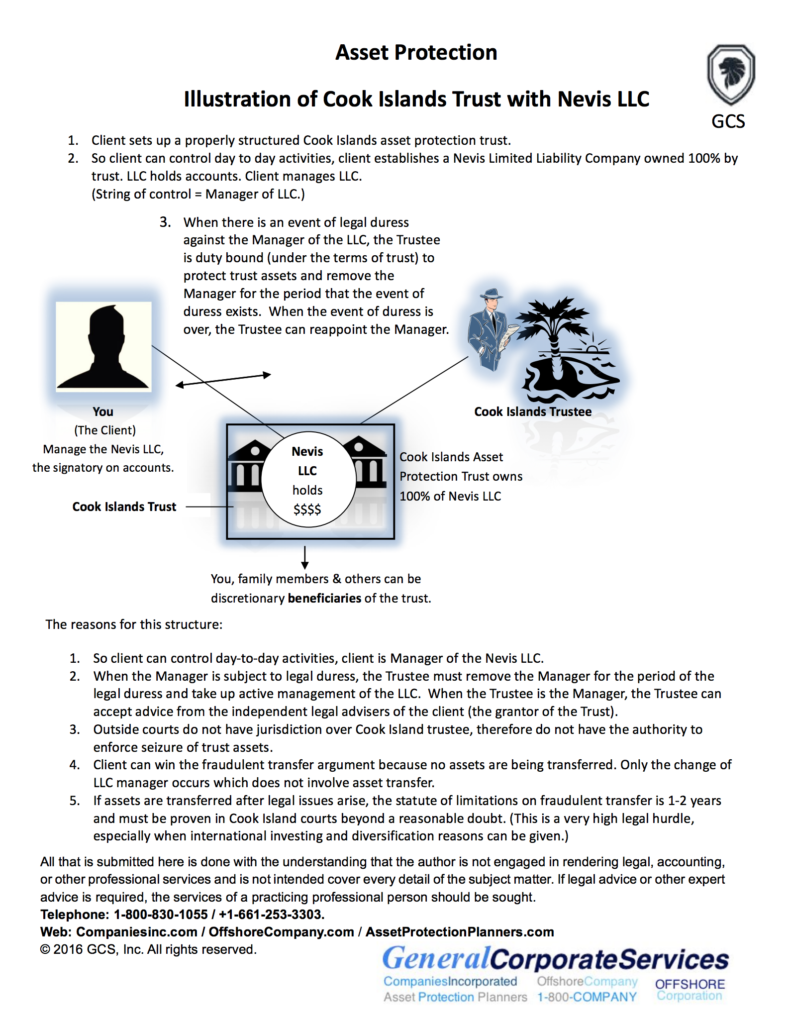

Move the possessions that are to be safeguarded into the depend on. Depend on proprietors might first produce a limited liability company (LLC), transfer possessions to the LLC and after that move the LLC to the depend on. Offshore depends site web on can be helpful for estate planning as well as asset protection yet they have restrictions.

residents who develop overseas trust funds can not get away all taxes. Revenues by properties put in an overseas count on are devoid of united state tax obligations. U.S. people who receive circulations as beneficiaries do have to pay United state revenue tax obligations on the distributions. United state owners of offshore depends on additionally have to submit reports with the Irs.

Some Ideas on Offshore Trust Services You Should Know

Corruption can be a problem in some nations. On top of that, it is very important to pick a nation that is not most likely to experience political unrest, routine change, financial upheaval or fast modifications to tax obligation policies that might make an offshore count on much less helpful. Asset security trust funds generally have to be established prior to they are required.

They also don't completely secure versus all claims as well as might reveal proprietors to risks of corruption and also political instability in the host nations. Overseas trust funds are helpful estate preparation as well as asset security devices. Recognizing the ideal time to use a particular depend on, as well as which depend on would certainly offer the most benefit, can be confusing.

An Offshore Trust fund is a normal Depend on formed under the laws of nil (or low) tax International Offshore Financial. A Trust is a lawful game strategy (comparable to a contract) whereby one person (called the "Trustee") in accordance with a subsequent individual (called the "Settlor") consents to recognize as well as hold the residential property to assist different individuals (called the "Beneficiaries").